By Paul Whimp

All organizations understand the importance of having a strategic plan however, most don’t due to their leaders being time poor and finding the process overwhelming.

A simpler alternative is to carry out a strategic SWOT exercise. The outcomes of this process will help provide some direction for the organization and pinpoint the areas where you can focus your limited time and energy to deliver the biggest improvements in your business.

Month: July 2021

Xero – Update To Yodlee Bank Feeds By 17 August

A Yodlee upgrade that’s happening soon means you need to update your bank feeds that use Yodlee by 17 August 2021. If you don’t, your bank transactions will stop importing into Xero automatically.

How to update:

1. Log in to Xero

2. Click ‘Accounting’ in the top menu bar, then click ‘Bank accounts’

3. Click the ‘Update bank connection’ button to get started

Once you update, your transactions will continue to flow into Xero.

Click here to find more detailed update instructions.

For further information please contact your Harris Black team member.

Work From Home Deductions: 80 Cents 52 Cent Method

To claim work from home deductions, you can use either the Fixed rate method or the Shortcut method.

Fixed rate method

You must have a dedicated work area such as a home office (not the kitchen table)

You can claim 52 cents per hour you worked from home which includes depreciation on home office furniture, electricity and cleaning your home office

You can also claim phone, data, internet, stationery, consumables and depreciation on your computer or laptop

Shortcut method

You can work anywhere in your house (including the kitchen table) and you don’t need a dedicated work area

You can claim 80 cents per hour you worked from home which includes depreciation on home office furniture, electricity and cleaning your home office as well as phone, data, internet, stationery, consumables and depreciation on your computer or laptop

Example

Bob works from home 40 hours per week. He keeps track of his phone and internet use for the month of July. Bob works out that 60% of his phone use is work related and 70% of his internet use is also work related.

Fixed rate method

40 hours per week x 52 cents x 48 weeks = $998.40

60% of his $120 phone bill x 12 months = $864.00

70% of his $100 internet bill x 12 months = $840.00

Bob’s total work from home claim = $2,702.40

Shortcut method

40 hours per week x 80 cents x 48 weeks = $1,536.00

No phone or internet can be claimed as it’s included in the 80 cents = $0.00 Bob’s total work from home claim = $1,536.00

Single Touch Payroll Reporting Changes From 1 July 2021

If you are an employer, you should currently be reporting your employees’ payroll information through Single Touch Payroll (STP), unless you only have closely held payees or a deferral or exemption covers you. However, as of 1 July 2021, there will be changes to STP reporting for small employers with closely held payees and quarterly reporting for micro employers.

As an employer of closely held payees (such as family members or a family business, directors or shareholders of a company), from 1 July 2021, you will need to report those payees through Single Touch Payroll software like any other employee. You will be allowed to choose when to report each payday, per month or by quarter.

From 1 July 2021, specific eligibility requirements will need to be met for micro employers to access the STP quarterly reporting concessions. These concessions will now include the requirement for exceptional circumstances to exist. In this case, micro employers refer to employers who have anywhere from 0 to between 1 and 4 employees for most of the year and then increase their workforce for less than three months of a financial year.

These concessions can be applied for through the ATO’s online deferral tool from 1 July 2021. Be advised, however, that employers who have not started reporting through Single Touch Payroll without a deferral or exemption could be liable for severe consequences.

For further information please talk to your Harris Black team member.

Free Legal Advice For Eligible Employers

Are you concerned about your legal compliance as an employer regarding workplace issues, such as employee dismissals, general protections or internal disputes like workplace bullying or harassment? Not sure what advice might apply to your situation?

Suppose you are an employer of a small business. In that case, you may not have access to the resources you need in your business structure to adequately answer some of the questions you may have about legal concerns for your business or provide your employees with guidance about legal matters. The Workplace Advice Service may be able to help if you are eligible.

It’s a service that seeks to promote access to justice, reduce complexity about legal matters for users and avoid unnecessary costs.

The Workplace Advice Service is a part of the Fair Work Commission’s Access to Justice Program and offers free legal advice nationwide. It partners with close to 90 private law firms, community legal centres, legal aid, and some barristers to provide free legal assistance to small business employers and employees concerning unfair dismissal, general protections and anti-bullying.

To determine if you are eligible for the Workplace Advice Service, you must have fewer than 15 employees and not have:

Membership with an employer association

In-house staff who specialise in workplace relations, human resources or law

Legal representation

If you are concerned about your legal compliance but are not eligible for this service, it’s best to seek assistance from a legal professional.

Meet The Staff – Kimberley Ward

Kimberley started with Harris Black in 2012 as a Personal Assistant and Administrative Assistant, and has since progressed to become Practice Manager in 2017.

Some interesting facts about Kim – born in Brisbane, Queensland, Kim’s favourite sport to watch is NRL, her favourite sport to play is TRL (touch rugby league) and if she could give a 40 minute presentation with no preparation, it would be about rugby league. If Kim could choose any 3 places to visit on an overseas holiday, she would visit Ireland, Norway and the Greek Islands, but the most relaxing place she has been is the Maldives. Kim enjoys gardening, playing sport and going for walks and a skill she would like to master is learning a second language.

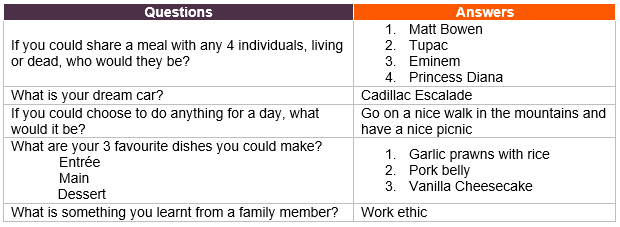

An excerpt of the interview with Kim is below: