Meeting the Basic Conditions

By Bjorn Kirberg

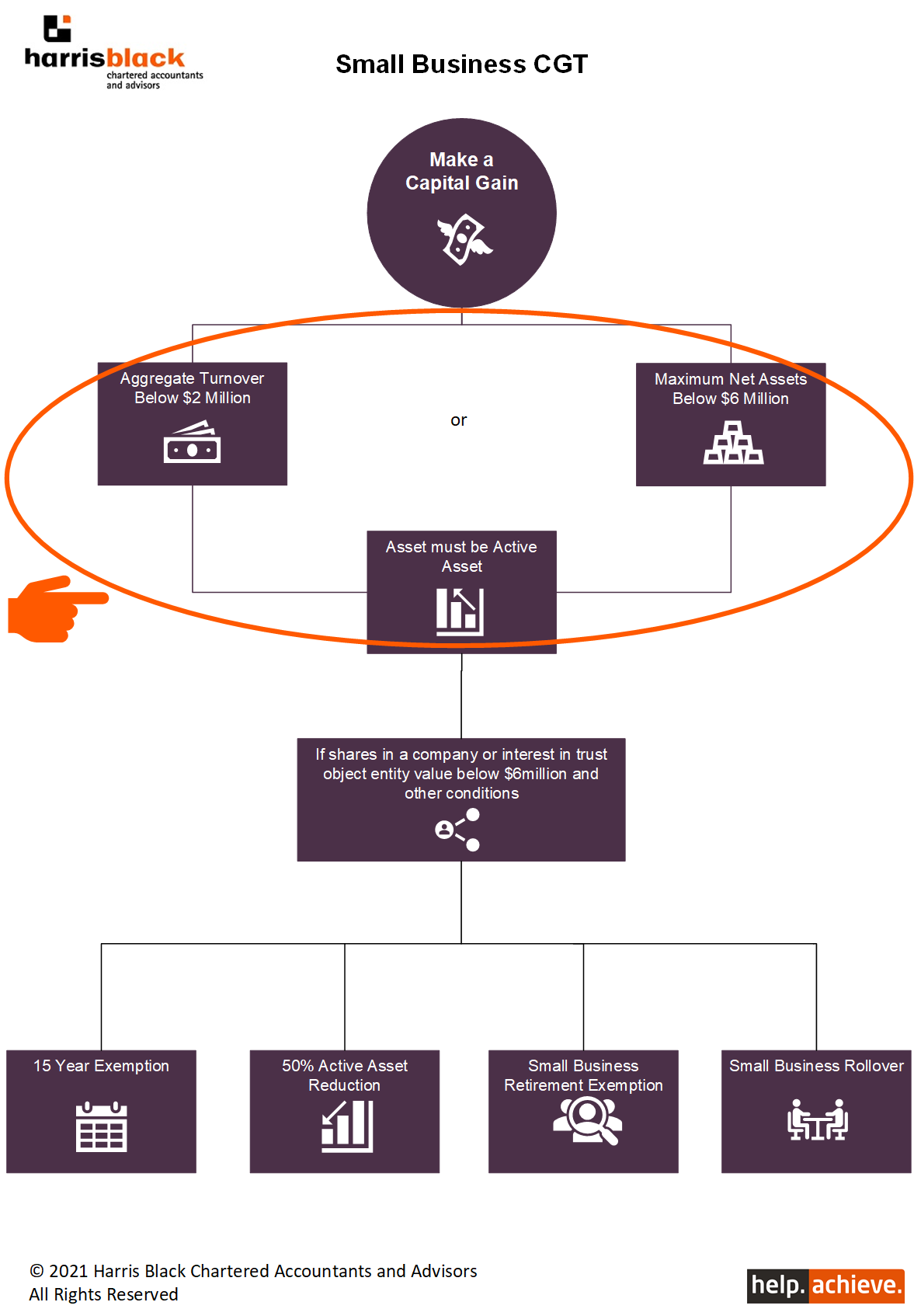

To qualify for the Small Business CGT Concession:

you must be considered a “Small Business”; OR

the maximum net assets of your business must be below $6million; AND

the asset being sold must be an “active asset”.

So… Is your entity a Small Business?

You are a Small Business if you are a sole trader, partnership, company or trust that:

operates a business for all or part of the income year; and

has a turnover less than $2 million

Turnover includes the turnover of connected entities and affiliates of the business and their connected entities.

Turnover can be worked out based on the previous year’s turnover, an estimate of your current year turnover or your actual current year turnover. There are some exceptions and special rules if you are not using your previous year’s turnover.

Are the maximum net assets of the business below $6 million?

Net value of CGT assets:

owned by the taxpayer (and entities connected with the taxpayer); and

used or held ready to use in a business carried on by the taxpayer (or an entity connected with the taxpayer); and

owned by the taxpayer’s affiliates (and entities connected with their affiliates)

must not exceed $6 million (the “maximum net asset value” test) just before the sale of the active asset which created the CGT event.

Is the asset being sold an Active Asset?

If the entity is either a small business OR the entity satisfies the $6 million net asset value test, the asset being sold must also be an Active Asset for the business to qualify for a Small Business CGT Concession.

Active Assets are those owned by the taxpayer and used or held ready for use in carrying on a business. The asset is not considered an Active Asset if it is held for a passive investment, rental property, financial instrument, loan etc. Obviously there is a large degree of complexity in the above rules. Please contact us if you would like to discuss further or have any questions.