From 1 January 2025, Australia has enacted reforms criminalising the deliberate underpayment of employees. This legislative change aims to enhance protections for workers and hold employers accountable for intentional underpayment of wages and entitlements.

Key Provisions of the New Legislation

- Criminal Offence: Employers who intentionally underpay employees are now committing a criminal offence under the Fair Work Act 2009. This includes deliberate failures to pay wages, superannuation contributions, or other entitlements owed to employees.

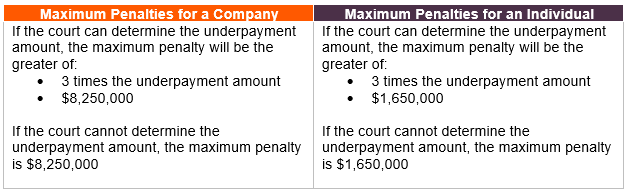

- Penalties1: Individuals found guilty of deliberate wage theft may face up to 10 years in prison. The penalties can also be quite significant:

It isn’t just the employers who can be prosecuted. Payroll managers and accountants – where their conduct contributed to the underpayment – may also be held accountable.

- Scope: The offence targets intentional underpayments, excluding honest mistakes or inadvertent errors. For example, accidental underpayment due to a banking error would not be considered wage theft under this provision.

What should we do?

Employers are now required to implement robust payroll systems and conduct regular audits to ensure compliance with wage and entitlement obligations. The Fair Work Ombudsman has outlined that businesses can avoid criminal prosecution by adhering to the Voluntary Small Business Wage Compliance Code, which provides guidelines for demonstrating compliance.

Some of the key action items include:

- Check the correct pay rates and entitlements for relevant enterprise agreements

- Assure employees are correctly identified under their award/enterprise agreement

- Update factors that could affect pay rate including age, location, hours of work

- Pay all relevant entitlements including minimum hourly rates, loadings, penalty rates, other identifiable amounts

- Follow payslip or record keeping requirements – providing pay slips within one working day, including all required information on the payslips

- Get help where needed – seek advice from your accountant, industrial professionals, or the Fair Work Commission

Cooperation Agreements

An employer who voluntarily comes forward about their conduct that could be a criminal offence can enter a written cooperation agreement with Fair Work. This will prevent application of criminal prosecution on conduct specified in the agreement.

Nonetheless, civil enforcement options may still be undertaken.

1 A guide to paying employees correctly and the Voluntary Small Business Wage Compliance Code