Challenge

Many of our clients fit into a similar profile… Do any of these circumstances sound familiar?

The big 5-0 is either looming or just passed you.

You earn a mix of personal and business income.

Your business affairs are well managed however you pay less attention to your day-to-day living costs.

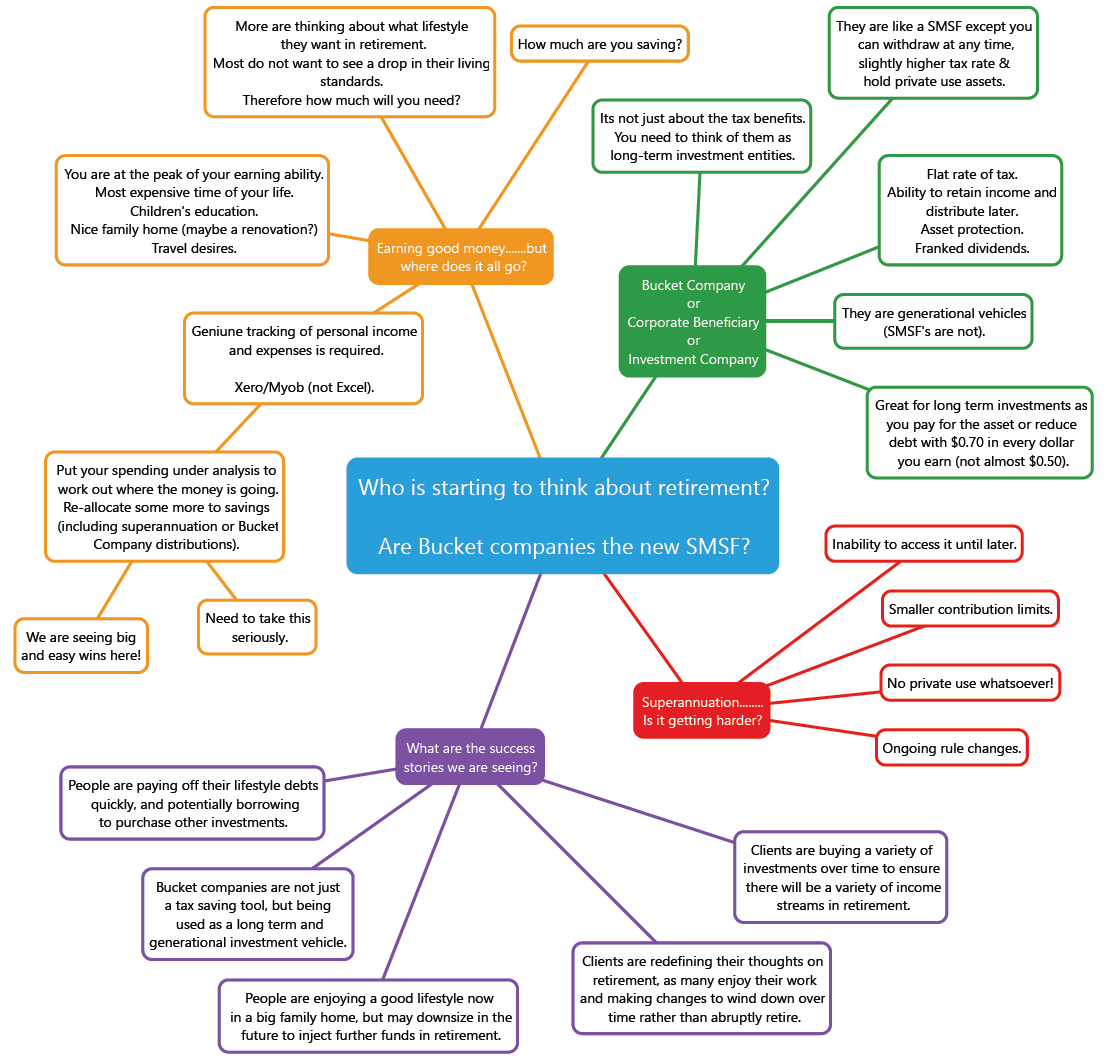

You are at the peak of your earning ability & have a good lifestyle but wonder where all the money actually goes. (Yet you aim for a higher standard of living, want your children to have a good education, want to live in a nicer home, love big annual holidays with family etc).

You are thinking more about your Superannuation (and other investments) and wonder if it will be enough to maintain the retirement lifestyle you desire.

Superannuation no longer has the allure if previously did, with:

– continual rule changes / limits on contributions;

– no scope for succession (it ceases when you die);

– an inability to access it ahead of retirement for personal use; and

– still years until you can access it.

You’re enjoying work, and aren’t sure what retirement looks like. Do you need to retire, or can your role adapt?

Solution

Like many of our clients, you might be realising it’s time for some changes. You too may have a busy personal and business life and are wondering where all the money goes each month.

There is a need for you to create the right circumstance now to ensure you are financially secure in the future (this doesn’t mean retired necessarily). Typically, you will need to be debt-free in retirement and will need investments both inside and outside of superannuation to fund a lifestyle similar to that which you are enjoying now.

With the help of an external bookkeeper, your personal income and expenditure can be put into an online accounting platform so you can start to:

analyse both money going in and out of personal accounts;

identify expenses that will reduce in the future (e.g personal insurance, education etc); and

look for areas of waste.

Outcome

By introducing a platform which allows you to focus also on personal expenses, you will be more able to reduce financial waste and channel the resultant savings into:

debt reduction;

distributions to bucket companies; and

superannuation contributions.

Where investments are made in either a superannuation or bucket company environment, this ensures more of your after-tax money is used for investment and debt reduction.

All of these improve your Net Wealth, ensuring you are on track to being financially secure in the future.