By Bjorn Kirberg

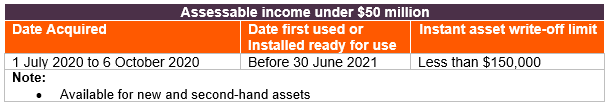

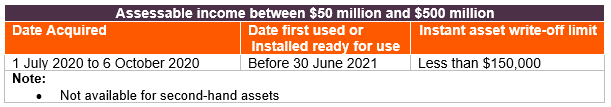

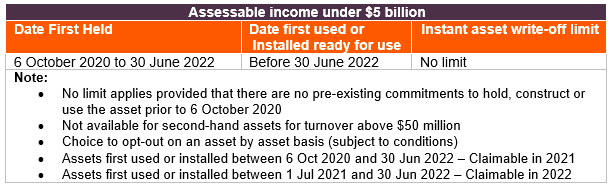

Instant asset write-off tables – based on entity aggregated turnover

50% Accelerated Depreciation (Assessable income $500 million and under) – Over $150k

A 50% deduction applies from 12 March 2020 until 6 October 2020 and is only available to new assets (not second-hand) purchased for $150,000 or more and first held by 6 October 2020.

The 50% deduction is available in the year of installation with the remainder of the asset’s cost being depreciation under the usual depreciation rules.

Instant Asset Write-Off Implications and Restrictions

Only available for Australian businesses, where the asset is used and located in Australia.

Not available for equipment purchased in a related entity such as a machinery hire company or a service entity which on-charges the operating business for use of the asset.

Not available for Division 43 capital works assets or assets allocated to a low-value pool.

For companies, this could cause a loss which may be beneficial if wanting to use loss carry back.

General Small Business Pools

Entity’s with a small business pool must write off the full pool balance in the 2021 financial year.