By Brendan Power

At Harris Black, we have noticed a growing trend with clients taking an ever increasing interest in their personal wealth position, including how they will retire, and what will happen when they have passed away.

In the last dozen years there have been 2 major events, being the GFC and more recently the Covid19 pandemic. These have made people look past their business affairs, and more inwardly at their own personal future retirement and estate planning situation.

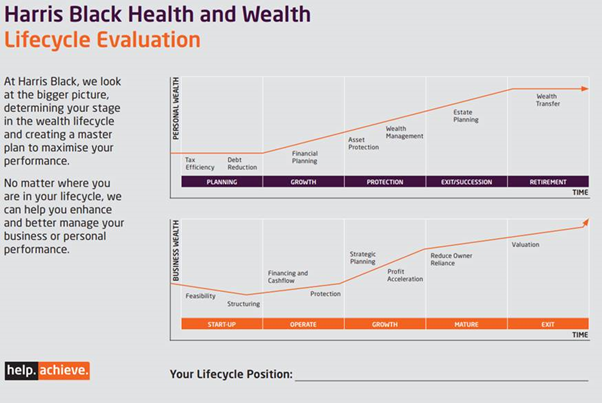

Nearly all our clients focus a large amount of their time and energy on their plans for business growth and business success and this often overshadows their consideration and management of personal affairs – eg reducing debt, accumulating and protecting their wealth, and planning for retirement and (sadly) their eventual death.

When completing clients’ personal work or during tax planning, we discuss what estate planning has been documented in the past. Often this is just a simple Will (or worse, no Will). Ultimately, many things may have occurred since the making of an initial or simple Will which can render it relatively ineffective, such as:

- marriage

- minor children,

- adult children,

- family trusts,

- life insurance policies,

- superannuation and the possibility of reducing the tax burden upon your death,

- corporate beneficiaries (bucket company’s),

- large beneficiary loans,

- debts between entities,

- debts with bans,

- unequal loans or gifts to family members,

- inheritances already received, or potentially receivable that will change your wealth position dramatically, and

- concerns about your children’s current and future marriages (bloodline)

We have been able to assist clients in their initial selection of a suitable family planner lawyer (we have several we can recommend), and are generally involved in the initial discussions around their current structure, supply of key documents and often are part of discussions and raising questions on behalf of our clients. We effectively help project manage the estate planning process, as we want to ensure it suits our clients’ needs and that new (more effective) Wills actually get signed.

Other important aspects often get raised as part of this process, including:

- Gifting to adult children (ie providing some assistance along the way, not just when you pass away)

- Letter of wishes – this accompanies your Will, and whilst not legally binding it can provide guidance on how you would like things to be managed in the future

- The use of a Testamentary Trust

- Who is suitable Executor and/or Trustee of your Testamentary Trust – both now and in the future (eg when children become older)

Please give these points some thought, and we would be happy to have an initial chat around any concerns you may have.