Division 7A, is a measure that prevents tax-free distribution of profits to shareholders or associates of shareholders of a company. This could be in the form of loans or debts that get “forgiven” or won’t be paid back in the foreseeable future. Since loans do not meet the definition of a “dividend” – these would essentially be tax-free distributions.

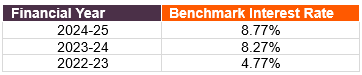

Division 7A does not let this happen by stipulating that such amounts transferred to shareholders or their associates will be treated as dividends. Alternatively, these payments can be classified as loans as long as they are bound by genuine commercial terms (s109N). For such a payment to be treated as a loan and not a dividend, there must be a loan agreement in writing. The loan interest must be in line to a “statutory” interest rate (aka benchmark interest rate) that the ATO updates for each year; the loan must also last for no longer than 7 or 25 years – depending on whether it is secured or unsecured.

Other conditions that must be met for such a loan to be a “Division 7A complying loan” is the condition of an annual minimum repayment. If say, your minimum repayment amount for the financial year is $30,000 but you only pay back $25,000, the shortfall ($5,000) would be deemed as an unfranked dividend for the financial year.

One may creatively argue that it is okay to repay the loan very conveniently just before the end of the financial year – only to take the same or greater amount of money out of the company at the beginning of the next financial year. This is where s109R of Div7A comes in.

s109R discredits such schemes and makes sure only certain repayments count towards the annual repayment of a Div7A loan. In a nutshell, it says that the following scenarios do not count towards a repayment when it is clear for a reasonable person to establish that

payments were made only to be redrawn in the form of a similar or larger loan later on

OR

when a new loan is drawn which is in value similar to or larger than the minimum repayment that is due.

If a new loan undertaken is significantly lower than the minimum repayment, it should not result in the implementation of s109R.