By Bjorn Kirberg

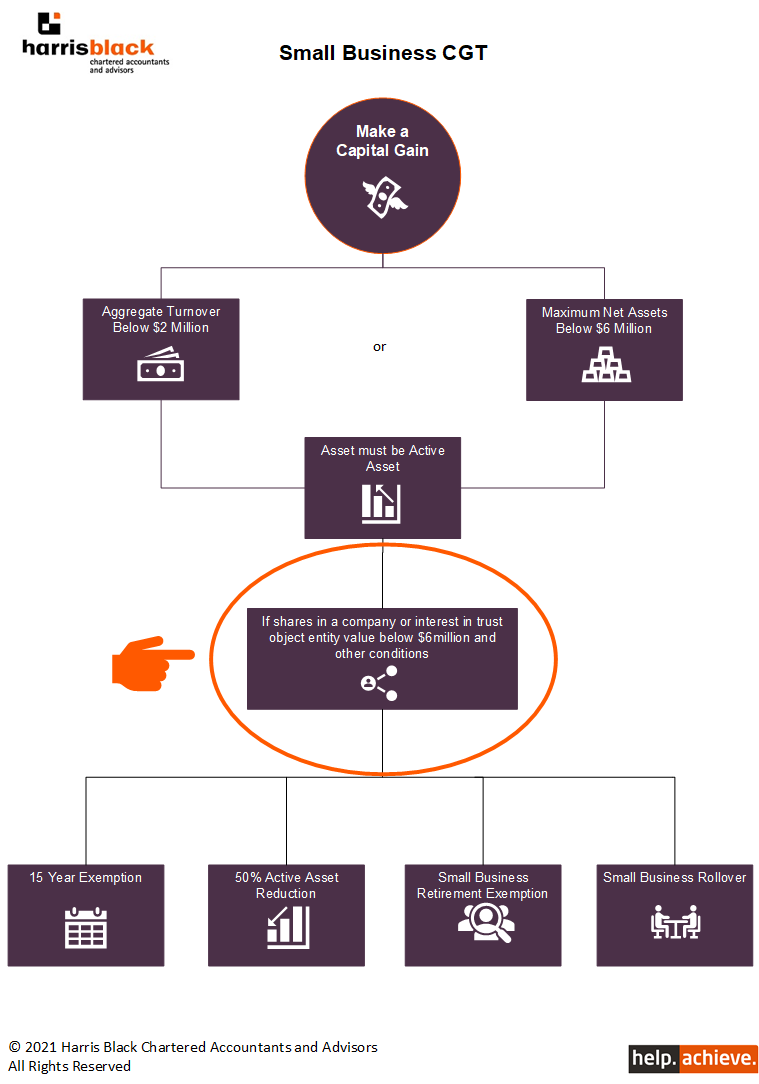

In Part 1 and Part 2 we covered the basic conditions of the CGT Small Business Concessions.

Part 3 will cover the common scenario where the asset being sold is a share in a company or an interest in a trust. This is especially helpful in Queensland to avoid stamp duty.

If the asset being sold is a share in a company or an interest in a trust, it must meet additional conditions outlined below. These rules were expanded in 2018 to ensure that the entity itself being sold could not be worth more than $6 million, which significantly narrowed the number of taxpayers eligible.

(1) Just before the CGT event, either:

(i) The taxpayer must be a CGT concession stakeholder in the company or trust; or

(ii) CGT concession stakeholders in the company or trust had a total small business participation percentage in the taxpayer claiming the concession of at least 90%.

(2) Unless the taxpayer satisfies the maximum net asset value test, it must be carrying on a business just prior to the CGT event.

(3) The company or trust must either be a CGT small business entity (below $2 million aggregated turnover) for the income year or satisfy the maximum net asset value test (net assets below $6 million).

(4) The share in the company or interest in the trust must satisfy a modified active asset test (MAAT). Work out the total market value of both:

(i) the assets of the company or trust and

(ii) the assets of any later (interposed) entity in which the taxpayer has a small business participation percentage, multiplied by that percentage.

To meet the MAAT, at least 80% (the 80% test) of the above assets must be made up of:

active assets and

cash or financial instruments inherently connected with the business carried on by the company/trust or a later entity

Definitions

A CGT Concession stakeholder of a company or trust is a significant individual in the company or trust, or the spouse of a significant individual where the spouse has a small business participation percentage in the company or trust.

Small business participation percentage is the sum of the direct and indirect small business participation interests.

A significant individual has a small business participation percentage in the company or trust of at least 20%.

These rules are very complex and this is just an overview. Please contact us if you would like to discuss further or have any questions